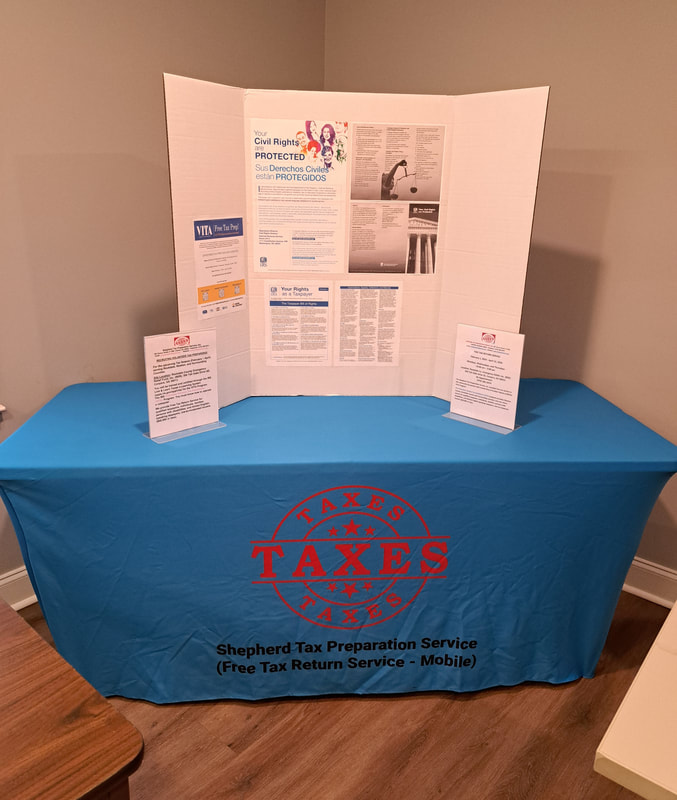

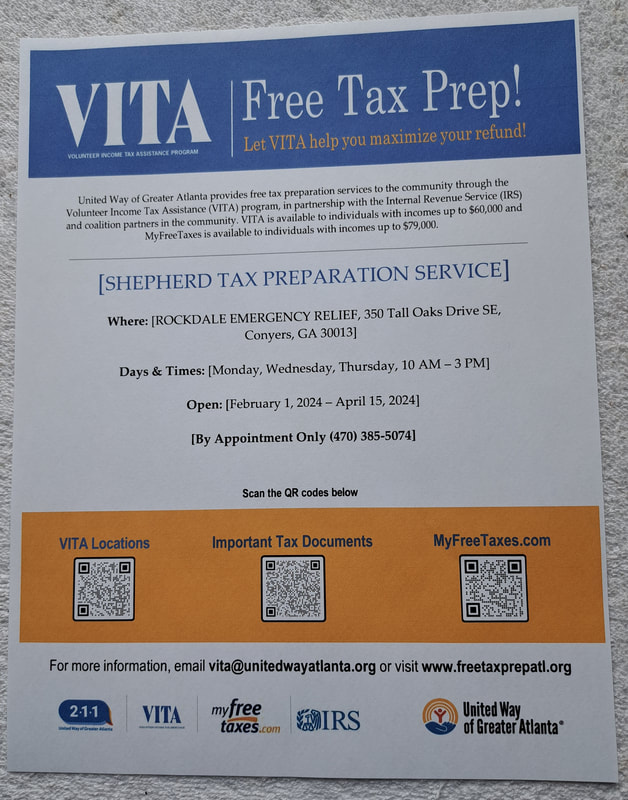

Our 3rd tax season 2023 - (February 1, 2024 - April 15, 2024) serving Rockdale County, Newton County and surrounding Counties for the 2023 tax season. Providing free tax service for low to moderate income families in the community partnering with the United Way of Greater Atlanta (UWGA) Community Engagement (Volunteer Income Tax Assistance) VITA Program.

Two Site Location: Rockdale Emergency Relief, 350 Tall Oaks Drive SE, Conyers, GA 30013, Rockdale County and Newton County Senior Services Center, 6183 Turner Lake Road, Covington, GA 30014, Newton County.

ACCOMPLISHMENT:

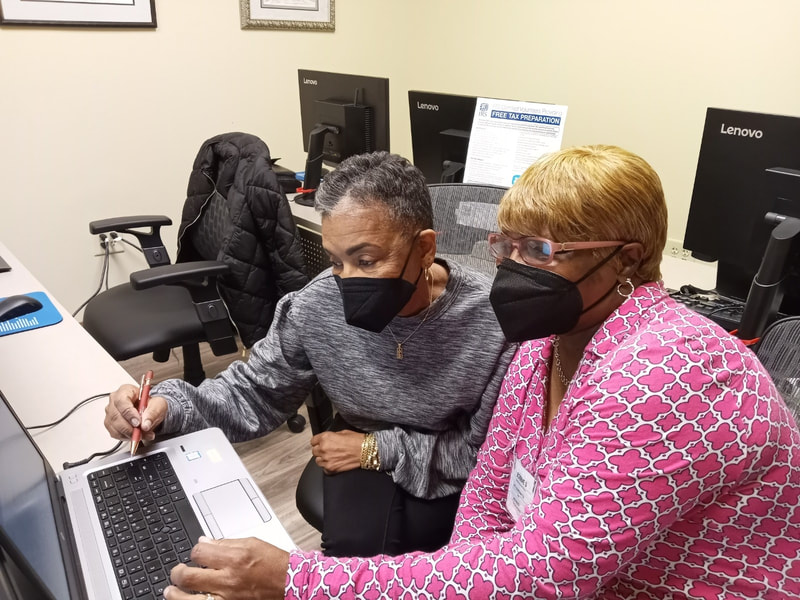

Four IRS-certified and trained volunteers Tax Prepares provide free basic income tax return service to taxpayers. 199 - tax returns were electronically filed to the IRS and to the State. We processed the highest percentage increase in EITC Returns in 2024.

The Earned Income Tax Credit (EITC), sometimes called EIC, is a tax credit for workers with low to moderate income. Eligibility for the tax credit is based on various factors including family size, filing status and income.

Two Site Location: Rockdale Emergency Relief, 350 Tall Oaks Drive SE, Conyers, GA 30013, Rockdale County and Newton County Senior Services Center, 6183 Turner Lake Road, Covington, GA 30014, Newton County.

ACCOMPLISHMENT:

Four IRS-certified and trained volunteers Tax Prepares provide free basic income tax return service to taxpayers. 199 - tax returns were electronically filed to the IRS and to the State. We processed the highest percentage increase in EITC Returns in 2024.

The Earned Income Tax Credit (EITC), sometimes called EIC, is a tax credit for workers with low to moderate income. Eligibility for the tax credit is based on various factors including family size, filing status and income.

CHALLENGE:

There are large numbers of low-income families in Covington Georgia and surrounding cities who fail to claim available tax credits because they lack access to certified, trained IRS tax preparers. According to the U.S. Census Bureau, 29 percent of the population in Covington lived in poverty in the period between 2016 and 2021, and the median household income was $39,845.

ACCOMPLISHMENT:

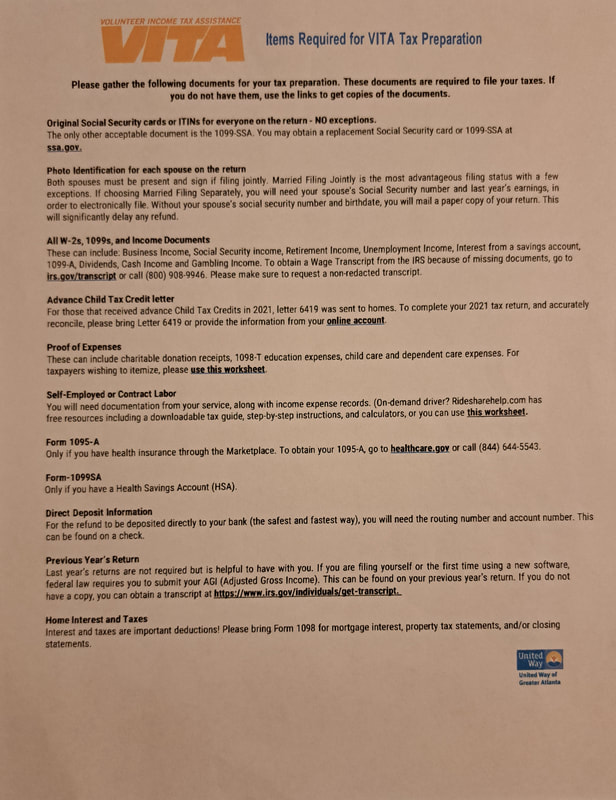

Our 1st tax season (January 1, 2022 - April 18, 2022) serving Newton County and surrounding Counties for the 2021 tax season. Only Two IRS-certified and trained volunteers provide free basic income tax return service to 58 taxpayers. Only 57 - tax returns were electronically filed to the IRS and State; only 1 - paper tax return were mailed to the IRS and State. Site location: Newton County Senior Services Center, 6183 Turner Lake Road, Covington GA, Newton County.

There are large numbers of low-income families in Covington Georgia and surrounding cities who fail to claim available tax credits because they lack access to certified, trained IRS tax preparers. According to the U.S. Census Bureau, 29 percent of the population in Covington lived in poverty in the period between 2016 and 2021, and the median household income was $39,845.

ACCOMPLISHMENT:

Our 1st tax season (January 1, 2022 - April 18, 2022) serving Newton County and surrounding Counties for the 2021 tax season. Only Two IRS-certified and trained volunteers provide free basic income tax return service to 58 taxpayers. Only 57 - tax returns were electronically filed to the IRS and State; only 1 - paper tax return were mailed to the IRS and State. Site location: Newton County Senior Services Center, 6183 Turner Lake Road, Covington GA, Newton County.

Our 2nd tax season 2022 - (February 1, 2023 - April 18, 2023) serving Rockdale County, Newton County and surrounding Counties for the 2022 tax season. Providing free tax service to low income families in the community partnering with the United Way of Greater Atlanta (UWGA) VITA Program. Two Site Location: Restoration Storehouse Center, 1400 Parker Road, Conyers, GA 30094, Rockdale County and Newton County Senior Services Center, 6183 Turner Lake Road, Covington, GA 30014, Newton County.

ACCOMPLISHMENT:

Our 2nd tax season (February 1, 2023 - April 18, 2023) only Two IRS-certified and trained volunteers provide free tax return service to 129 taxpayers. Only 122 - tax returns were electronically filed to the IRS and State; only 7 - paper tax returns were mailed to the IRS and State.

ACCOMPLISHMENT:

Our 2nd tax season (February 1, 2023 - April 18, 2023) only Two IRS-certified and trained volunteers provide free tax return service to 129 taxpayers. Only 122 - tax returns were electronically filed to the IRS and State; only 7 - paper tax returns were mailed to the IRS and State.

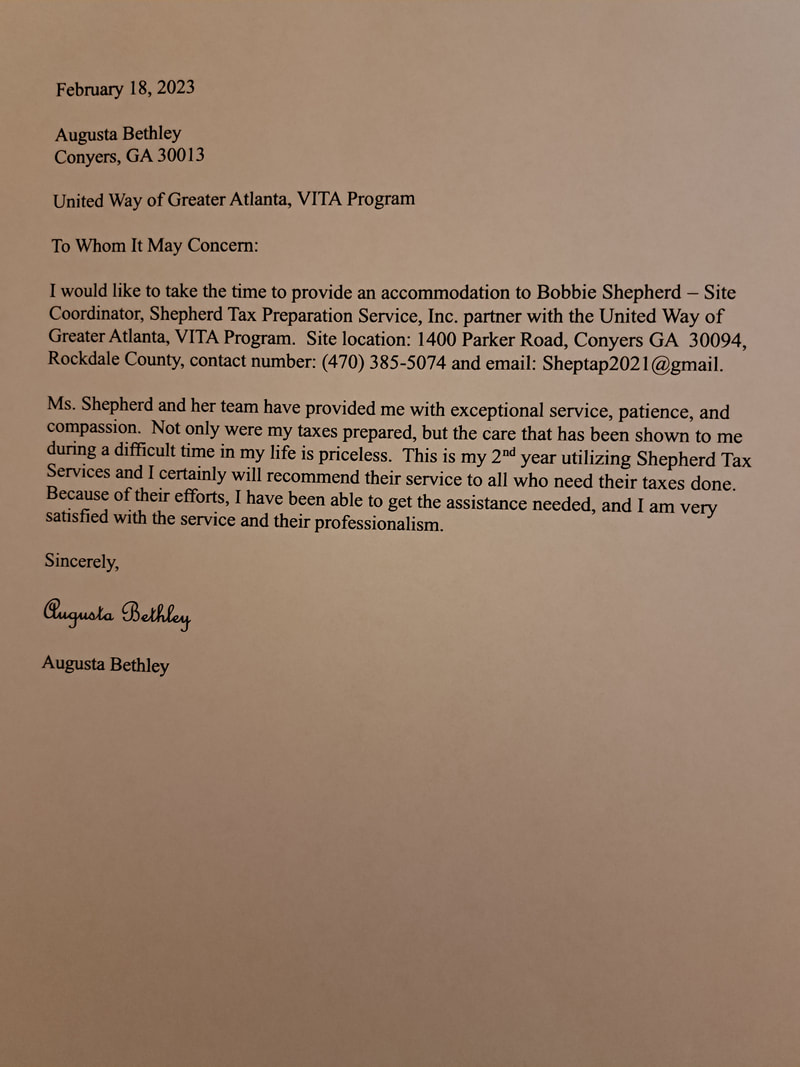

Success Story by Augusta Bentley - 2021 and 2022 Tax Season

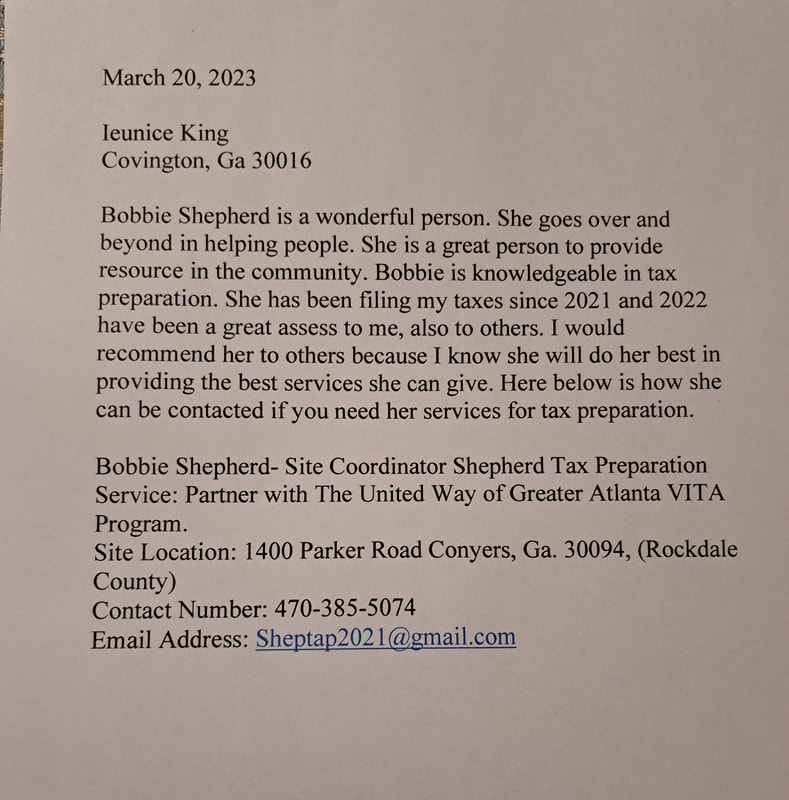

Success Story by Ieunice King - 2021 and 2022 Tax Season

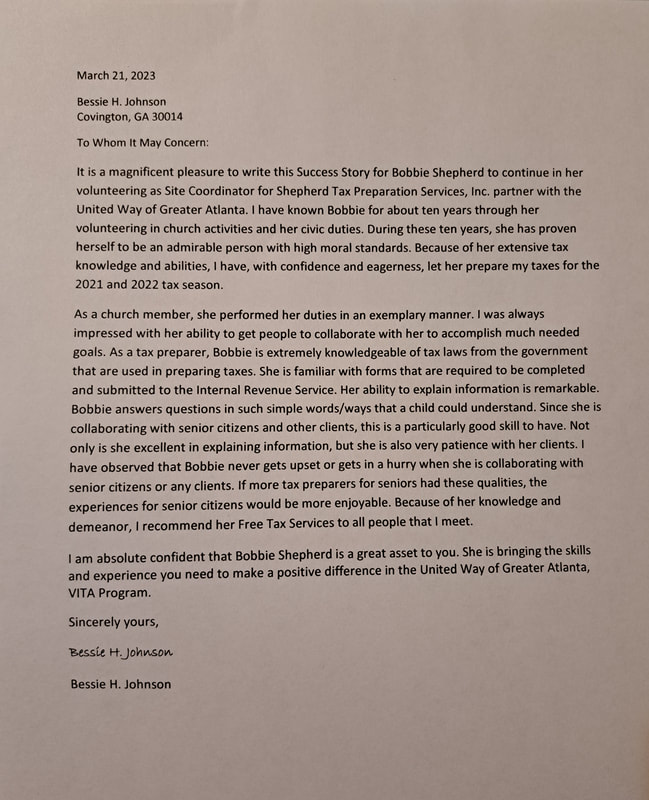

Success Story by Bessie Johnson - 2021 and 2022 Tax Season